Spring ’18 Joint CSC@USC/CommNetS-MHI Seminar Series

|

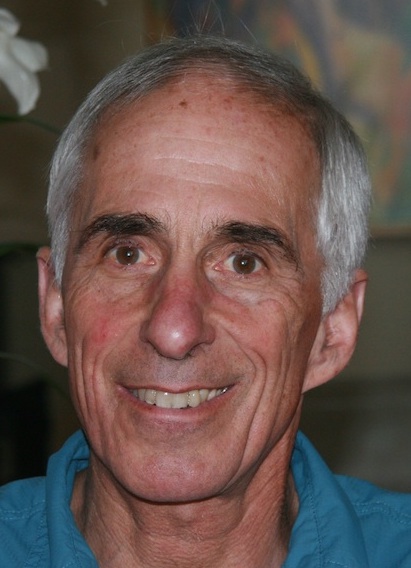

B. Ross Barmish,

University of Wisconsin, Madison

|

Abstract

This talk begins with a description of some ideas related to gambling which originated at Bell Labs in the 1950s by John Kelly and Claude Shannon. With their work serving as motivation for this talk, I will provide an overview of my research on the development of new stock-trading algorithms. The most salient feature of my approach is that no model of any sort is used for the underlying stock-price dynamics. Instead, in the spirit of technical analysis, the size of the time-varying stock position is determined using some simple ideas involving the adaptive power of feedback control loops. This approach is said to be “reactive” rather than predictive and amounts to assigning high priority to sound money management. After the key ideas driving this research are explained, the back-testing of the trading algorithms using historical data will be addressed with attention paid to practical considerations such as transaction costs, leverage and margin. It is interesting to note that sometimes the simulations lead to unexpected results which were not contemplated during the course of the research.

Biosketch

B. Ross Barmish is Professor of Electrical and Computer Engineering at the University of Wisconsin, Madison. Prior to joining UW in 1984, he held faculty positions at Yale University and the University of Rochester. From 2001-2003, he served as Chair of the EECS Department at Case Western Reserve while holding the Nord endowed professorship. He received his Bachelor's degree in EE from McGill University and the M.S. and Ph.D. degrees, also in EE, from Cornell University.

Throughout his career, he has served the IEEE Control Systems Society in many capacities and has been a consultant for a number of companies. Professor Barmish is the author of the textbook “New Tools for Robustness of Linear Systems” and is a Fellow of both the IEEE and IFAC for his contributions to robust control. He received two Best Journal Publication awards, each covering a three-year period, from the International Federation of Automatic Control and has given a number of keynotes and plenary lectures at major conferences. In 2013, he received the IEEE Control Systems Society Bode Prize.

While his earlier work concentrated on robustness of dynamical systems, his current university research involves building a bridge between feedback control theory and trading in complex financial markets. In addition to this academic pursuit, in his capacity as CEO of Robust Trading Solutions, his work involves transition of stock-trading algorithms from theory to practice and government sponsored research on the NASDAQ Limit Order Book.